arizona charitable tax credits 2020

There are four steps to document your donation and claim your tax credits. For all of them you have until April 15 2021 or until the date you file your return if you do so early to donate for the 2020 tax year.

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

2519 - Single.

. Qualifying Charitable Organizations and Qualifying Foster Care Charitable Organizations. February 16 2020 206 PM. 2022 Brighter Tomorrow Virtual Event.

You can provide the in-home safety education module to a family for just 400. Credit for Contributions to Qualifying Foster Care Charitable Organizations - Form 352. You can provide free healthcare for those in need at no cost to you.

The Arizona Charitable Tax Credit is a dollar-for-dollar tax credit that reduces the taxpayers tax liability what is owed for AZ state taxes. Check out some resources to help you get the guidance and support you need. Donations made between January 1 2021 and April 15 2021 can be claimed as a credit on either your 2020 or 2021 state tax return.

With the Arizona Charitable Tax Credit you can donate up to 800 to St. When you invest 1500 in Parent Aid you provide weekly in-home support to a family for a full year which. 10 rows Arizona Small Business Income Tax Highlights.

Your investment of 800 supports community families growth in communication child development discipline and self-care by providing an entire class series. Everything you need to know to take advantage of the Arizona Charitable Tax Credit updated for the 2021 tax year. Tax Planning with Arizona Credits.

Vc_column_text vc_custom_heading textRead St. Your dollar-for-dollar tax credit donation to a Qualified Charitable Organization will support organizations assisting low income children individuals and families. There are two tax credits available to individual income taxpayers for charitable donations.

Arizona provides two separate tax credits for individuals who make. You can also get a tax break for making donations to a qualified charitable organization or foster care organization or to the Arizona Military Family Relief Fund which provides financial. Through the Arizona Charitable Tax Credit you can receive a credit on your Arizona tax liability up to 400 individually or 800 for couples filing jointly.

TOTAL credits available for 2021. That means you can still donate and get the credit if you havent already. The 2020 Definitive Guide to the Arizona Charitable Tax Credit Everything you need to know to take advantage of the Arizona Charitable Tax Credit in 2021 updated for the 2020 tax year.

You can claim these credits in addition to any private charitable giving or public-school tax credits. Neither Charter Schools nor programs run by charter schools are qualified schools for the purposes of this tax credit. The Arizona Foster Care Tax Credit offers a dollar-for-dollar reduction of your state income tax obligation for donations to a Qualifying Foster Care Charitable Organization such as AASK.

Marys Food Bank and get all of it back in your Arizona tax refund. One for donations to Qualifying Charitable Organizations and one for donations to Qualifying Foster Care. Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 22230 15 Hands Hearts Inc 8380 N Fleming Dr Flagstaff AZ 86004 928 310-0947 20266 1st Way Pregnancy Center PO Box 5294 Phoenix AZ 85016 602 261-7522.

These tax credits allow taxpayers to make charitable contributions and receive dollar-for-dollar reductions in their Arizona state. Any credits for charitable contributions to Qualifying Charitable Organizations QCOs and Qualifying Foster Care Charitable Organizations QFCOs not claimed in a tax year carry forward up to five years. Donate to a qualified charitable organization QCO or QFCO such as a 501 c 3 organization like Gompers.

However the Arizona tax credits are still a. The tax credit is up to 500 for individuals and up to 1000 for couples filing jointly. Currently the state of Arizona provides multiple individual tax credits including the Arizona Charitable Tax Credit and the Public School Tax Credit.

Key and Concise Point About Arizona Charitable Tax Credits. February 5 2020 311 PM. 800 Married filing jointly.

Up to April 15 2021. The state of Arizona provides a variety of individual tax credits including the Arizona Charitable Tax Credit and the Public School Tax Credit. Unfortunately the somewhat new tax laws no longer allow Arizona taxpayers to deduct Arizona tax credits as charitable contributions on Federal Schedule A.

When you donate up to 400 single filer and 800 joint filer to Pawsitive Friendships you may be eligible for the State of Arizona Qualifying Charitable Organization Tax Credit. Marys 2020 Arizona Charitable Tax Credit Guide Today font_containertagh3text_aligncenter use_theme_fontsyes vc_btn titleClick to. Public Education Tax Credits This tax credit opportunity allows you to donate to a public school and receive up to 400 tax credit when you file.

The credits are non-refundable. Find a Dedicated Financial Advisor Now. There are four major tax credits that you can use to offset certain charitable donations in Arizona.

Click the link for detailed info at the Arizona Dept. Click here to view a video to learn more about the credit. For the Arizona Credit for Contributions to Charitable Organizations Form 321 only Cash Donations qualify.

High Holiday Food Drive. What is an Arizona Tax Credit Donation. Single Head of Household HOH Married Filing Separate MFS or Married Filing Joint MFJ.

A couple filing a joint return in Arizona can qualify to redirect as much as 4965 for 2020. That exceed the allowable credit on Arizona Form 323 590 S MFS HoH. Maintain a receipt of your gift from the charity in order to provide a copy with your tax return.

New Look At Your Financial Strategy. There are five 5 different types of charitable donation credits to choose from with limits depending on your filing status end of the year. Private Education Tax Credits This tax credit.

Contributions to QFCOs made between January 1 2021 and April 15 2021 can be claimed as a credit on your 2020 or 2021 Arizona tax return. Unused amounts of credit carry forward for five years except for the military credit which does not carry forward. Complete the relevant tax form to claim one or more credits.

The Arizona Department of Revenue ADOR advises taxpayers they have until May 17 to make donations to qualifying charitable organizations to claim the tax credits on their 2020 individual income tax return. SCNM Sage Foundation is a Qualified Charitable Organization QCO eligible for the Arizona Charitable Tax Credit. Qualified Foster Care Organization Tax Credit This tax credit opportunity allows you to donate to a qualifying foster care organization and receive up to a 1000 tax credit when you file.

A taxpayer can contribute and take all the credits subject to the amount of state tax for any particular year. Visit The Official Edward Jones Site. Public Schools Form 322 A credit of up to 400 for married filing joint and 200 for all other filers is available for payment of fees to an Arizona public school or charter school for extracurricular activities or character education.

Do Your Investments Align with Your Goals.

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Qualified Charitable Organizations Az Tax Credit Funds

With 35 0 Continuing Education Credits Set To Be Available Avaatyourfingertips Is Continuing Education Credits Continuing Education Md Anderson Cancer Center

Arizona Charitable Tax Credit Donations St Mary S Food Bank

Average Faculty Salary By Sector Over Time Trends In Higher Education The College Board College Board Faculties Higher Education

Breakdown Of 2020 Az Tax Credits Sterling Accounting Tax Llc

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

List Of 6 Arizona Tax Credits Christian Family Care

Donate Now Tax Credit Open Hearts Family Wellness

What You Need To Know About Arizona 2021 Tax Credits

Qualified Charitable Organizations Az Tax Credit Funds

The Arc Of Tempe The Arizona Charitable Tax Credit Donation Deadline Is Almost Here On April 15 2020 Is The End Of The Donation Period For The 2019 Tax Year By

Arizona Tax Credits Mesa United Way

Cheapest Colleges In Arizona 2017 Collegestats Org College Rankings College Fun Dream School

Taxpayers Have Until May 17 To Donate To Charities Stos And Public Schools For 2020 Tax Year Smis

Qualified Charitable Organizations Az Tax Credit Funds

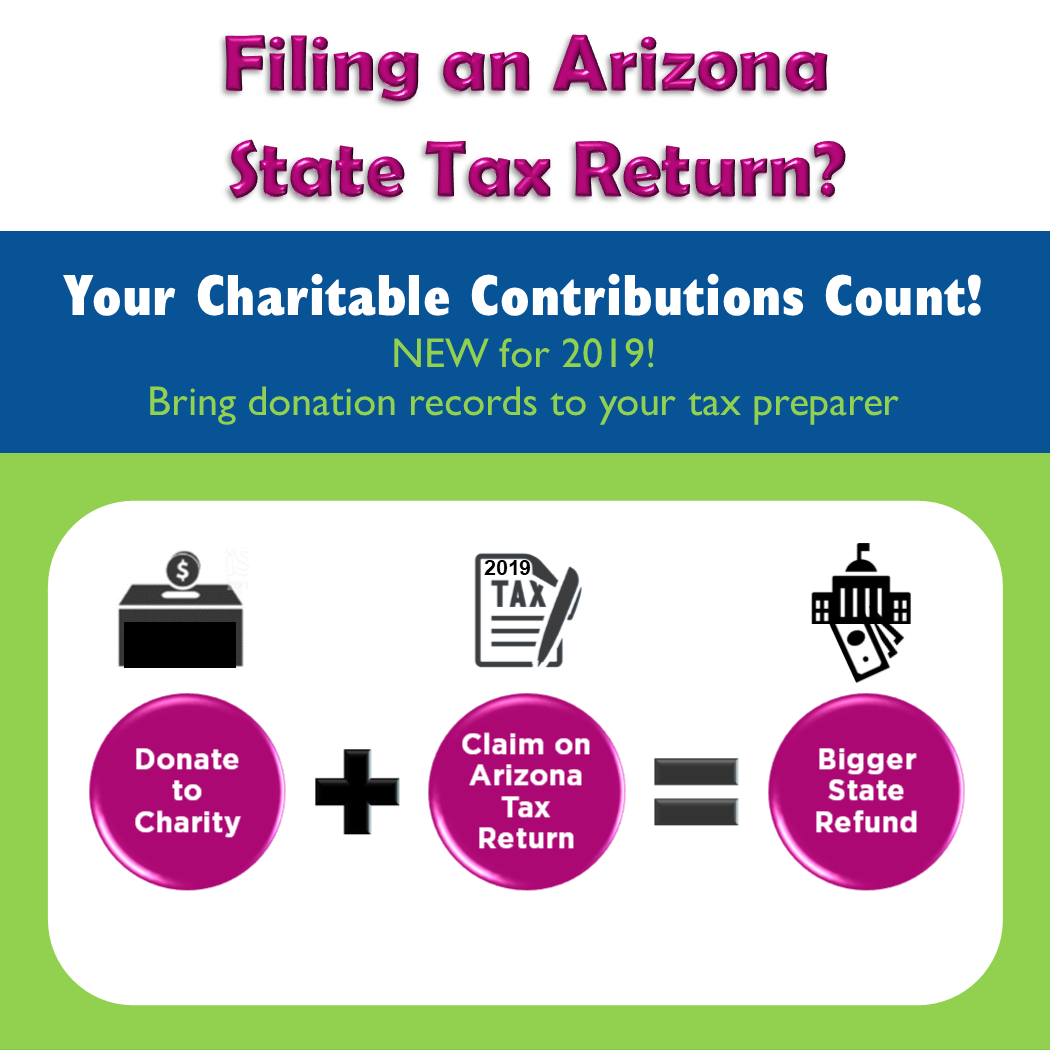

Charitable Contributions Count In Arizona Tempe Community Council

List Of 6 Arizona Tax Credits Christian Family Care

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S